Affinity Marketing and the Latino American Fintech Opportunity

An Empirical Case Study

Give me your tired, your poor.

Your huddled masses yearning to breathe free.

-Emma Lazarus

These United States

America is a nation of immigrants—and it has a complex history with them.

I am the son of two of them and I am grateful to have had the privilege of being born and raised in this amazing country.

Both of my parents are from Mexico, which means I am both Hispanic and Latino. For those of you that aren’t familiar with the idiosyncrasies of our great nation’s confusing ethnic categorizations, someone who is “Hispanic” is a person from, or whose parents are from, a Spanish-speaking country (this includes Spain, which is in Europe) and someone who is “Latino” is a person of Latin American origin or descent (this includes Mexico).

This distinction, while not terribly obvious to people outside of the demographic, is important only because it maps to a question on the US Census, which ultimately maps to important policy decisions our government makes and the people of this great country vote for.

Affinity Marketing

From a business and analytical perspective, this maps to a segment of the population that may, or may not, be interesting to cater to—at least, that was the premise behind my failed startup (a Personal Financial Management tool for Latinos).

The strategy of targeting a set of customers by some set of criteria is not novel; it is simply Affinity Marketing.

The Partitioning of Data

Analytically, the goal of finding Affinity groups is to find the fewest attributes possible that maximizes the similarity between a group of people and provides a simple description of the group in the hope that this increases the likelihood that they will buy your product or whatever.

This reduces to a form of dimensionality reduction and beyond a few dimensions it starts to get wacky. In fact, this is just Customer Segmentation, which I wrote about previously.

Being the pragmatists that we are, it is natural to try and find the most obvious groups that are the most similar; for example, using demographic information (e.g., age, income, education, geography, sex, or ethnicity). And Latino/Hispanic Americans fit that criteria quite nicely. In fact, Hispanics are the second largest demographic in the US.

Hispanics in Data

So we know that Hispanics represent a large segment in the US by the sheer number of people, which according to our data would estimate something around 63 million people (~19% of the US).

But, from a business perspective, we probably care about understanding this segment more; i.e., getting answers to the following questions:

What do Hispanics do?

What are their educational backgrounds?

How much do they make?

Where do they live?

And we can answer these questions using the open source library I wrote—PyIPUMs.

Note— Some of the data that follows may lead some to extrapolate and make value judgments about the data, which would be silly because correlation is not causation. Remember, it is useful to understand the world (and its data) as it is and not waste time judging it—even if relationships aren’t causal they can certainly tell you something interesting.

What do Hispanics do?

It turns out, labor. Relative to non-Hispanics, Hispanics are much more likely to work as construction workers, cooks, truck drivers, and in other labor-intensive occupations.

What are their educational backgrounds?

Hispanics, on average, have much less education which may explain the selection into labor-intensive occupations. Nearly 80% of Hispanics’ highest education is a high school diploma or less. For non-Hispanics this is closer to 60%.

It’s worth noting that Hispanics are, on average, younger, so this is an extremely important data point but I would exercise caution in making conjectures about the root cause of the differences in educational outcomes.

How much do they make?

A lot less than the average non-Hispanic but there’s a lot of variance! The median total income for Hispanics in the labor force was $34,901 and for non-Hispanics it’s $50,791. While the median is low, Hispanics in the 95th percentile have a total income of $123,300 so there are still some high income earners in this segment.

You may ask yourself, “Why not prioritize other higher income segments?” It’s a reasonable question but it’s worth remembering that software is best for high scale problems. That’s because the marginal cost of servicing another consumer through software is effectively zero. So, a large audience that is very similar is quite convenient, as their preferences and behaviors will likely be similar.

More importantly, Latino Americans have the 5th largest GDP in the world, so, uh, olé. 😉

Where do they live?

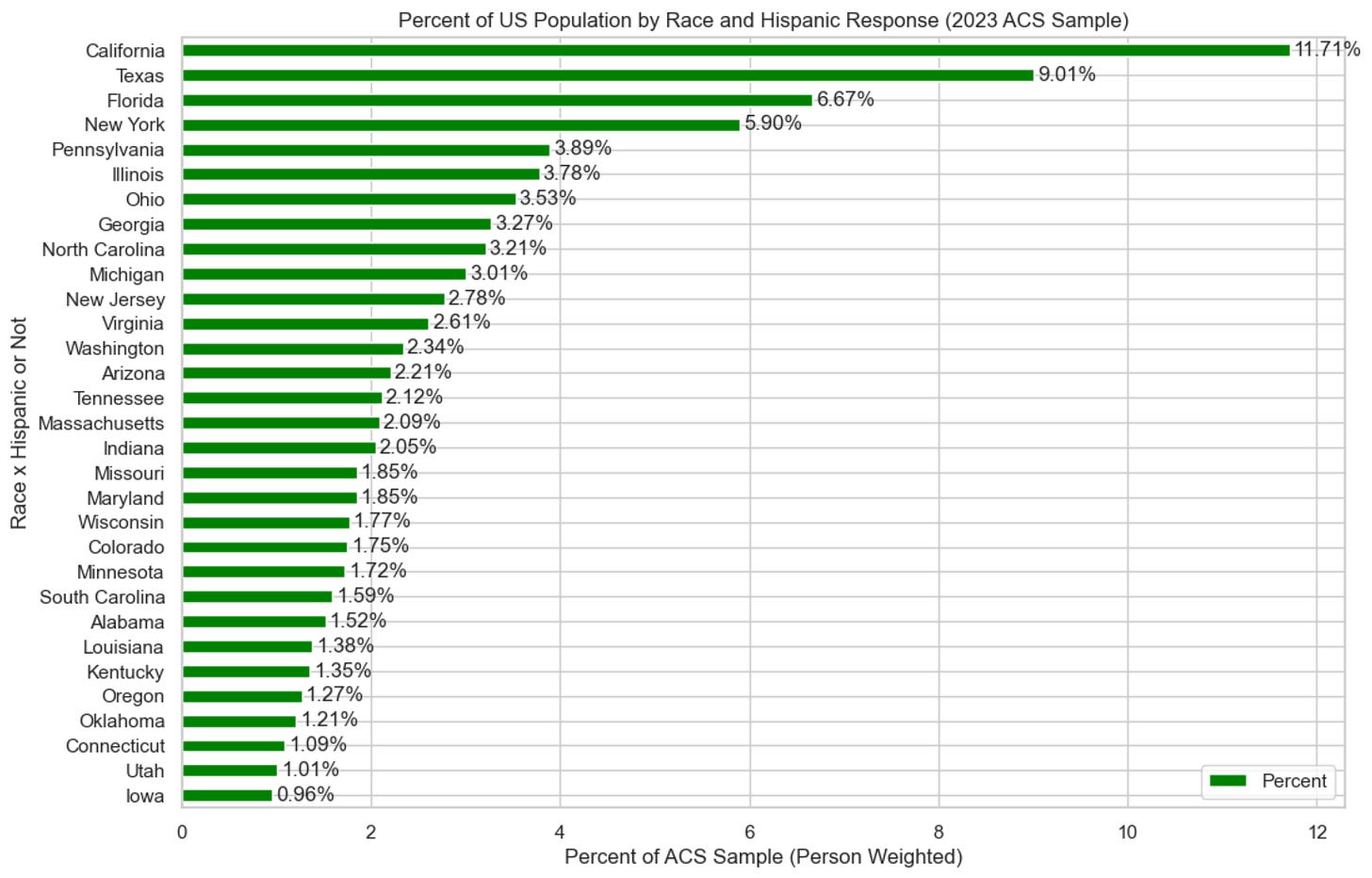

Approximately 33% of Hispanics live in four states. California and Texas used to be Mexico, so that’s not a huge surprise. 🤷♂️

So what?

So we’ve learned that Hispanics are:

A large chunk of people in the US (and apparently GDP)

Tend to work in labor-intensive jobs

Mostly have a high school diploma or less

Lower income (relatively speaking, of course)

Heavily concentrated in California, Texas, and Florida

Which is illuminating in understanding what sort of consumer preferences and challenges they may have…particularly for Fintech.

The Latino American Fintech Opportunity

Marketing isn’t enough to capture the attention of an affinity group, you have to deliver real value to them. That means going beyond the shallow and providing services that your target customers need.

In the case of Hispanics and Latinos, one foundational need is financial services in their primary language (a fairly obvious idea) and another is providing simple, transparent products that cater to a population that, on average, is less educated1.

No one has done a better job at serving this community more than Carlos Garcia from FinHabits.

Why? Because he never followed the bandwagon and has been patiently building useful products for his community since 2015.

He started with simple content, educational tools, and ETF/Roth investing. He’s since expanded to offering a 401k product and even helping consumers find health insurance.

Several years ago I had the privilege of having coffee with Carlos and I got to hear how he built this profitable Fintech firsthand and it was truly inspiring. I should note that I am not an investor in FinHabits but I sure wish I was.

Closing Thoughts

More startups have emerged since my failed foray into the Latino Fintech Market back in 2019 and I am bullish on the space since this segment of the population doesn’t seem to be getting smaller and I’d argue their needs still aren’t well met. While the product offerings have improved since then, I still think there’s a lot of work to be done.

More generally, while many Neobanks failed to be successful in delivering a successful Affinity strategy during the most recent Fintech Reckoning, I believe there are great consumer businesses left to be built and some of them will likely start from an Affinity group. Of course, I could be wrong. I suppose only time will tell.

Happy building! 🤠

-Francisco

Some Content Recommendations

Simon Taylor wrote a brilliant piece on BNPL being good. It’s brilliant, just like him. You should read it.

Jason Mikula wrote about the CFPB’s proposed role to close Overdraft Loopholes. Overdrafts are, for the most part, bad.

Alex Johnson from Fintech Takes covered three interesting fintech stores in a recent article.

Jake Gibson wrote a guest post for This Week in Fintech and shared great wisdom on building a startup the good old fashion way.

One could argue this is a always a good strategy—I would.

As a marketer that works in Fintech for Latinos, this data is incredibly valuable! I too was able to meet Carlos. Great stuff he has going on at FinHabits.