Lessons from my Failed Fintech Startup

How not to be a founder

This article was originally published on Every, check out the original here.

“That's one thing Earthlings might learn to do, if they tried hard enough: Ignore the awful times and concentrate on the good ones.”

― Kurt Vonnegut, Slaughterhouse-Five

Some history

I was 20 years old when I used my first credit card. One night in college I was working as a pizza delivery driver when my car broke down. It was late, there was a pothole, and my tire quite literally snapped off. I was sitting on the side of the road trying to call a tow truck and thinking about how I would be able to work tomorrow–worried if I’d lose my job–and how I’d afford rent if I didn’t work. Finally, the car got to the shop and they told me it would cost two thousand dollars to repair it. I didn’t have that kind of money.

I remember how scared I was not knowing how I could afford to repair my car, but then I remembered my credit card could provide me with the liquidity I needed. It wasn’t the cheapest money I could have used but I didn’t know any better and, regardless, the resolution of my crippling stress, anxiety, and fear was well worth the price I paid in interest.

I didn’t know much then but I knew that money helped me.

Fast forward to 2017. That fearful moment set me on a path to understand how finance worked and make it more accessible for others. I graduated and went on to get a masters in economics and statistics, and eventually another in data science and machine learning. I worked at financial institutions like AIG and the Commonwealth Bank of Australia.

Then a moment came that felt rather significant: I was approached by Goldman Sachs to join their consumer bank, Marcus.

It was a great opportunity not because it was Goldman but because I believed in the product they were building: a simple loan with transparent costs and no fees. What a wild product idea: transparency. Somewhat shockingly, this was novel at the time as many lenders had hidden fees and costs but Marcus is consumer-centric and I loved that.

I truly did love my time there and I actually thought I’d never leave...but I couldn’t help but notice a common theme in postmortems we were doing on non-performing loans: many of them were originated by Hispanics/Latinos. To be fair, they were not the worst performing loans, but as a Latino myself, these data points stood out to me.

As someone who grew up working class with immigrant parents from Mexico in the South side of Chicago, I thought to myself “Maybe I could build a product to help my community.” On paper, given my finance, technology, and personal background I was (arguably) uniquely positioned to do it.

So in 2019, I left Goldman to start my own company: Unidos. I built a personal financial management tool in both Spanish and English that aimed to educate and empower my community with a simple understanding of finance and interest. After 3 years, I can objectively say it was an utter business failure.

Which is the primary reason I am writing this article: to vent all of the mistakes I made so that, hopefully, you (and maybe even future me) can avoid them.

Remember, most startups fail which means that in probability if you are going to launch a startup, you will probably fail, too.

Be bold. Reject this data anyways but avoid the mistakes I once made.

All of the ways I failed as a founder 🥲

Some important facts about my experience as a founder:

I did not have any previous experience as a founder

I did have lots of experience at big companies

I was a very technical founder

I had significant misalignment with my cofounder

I was working full-time while doing my startup

I did not ever try to raise any venture capital1

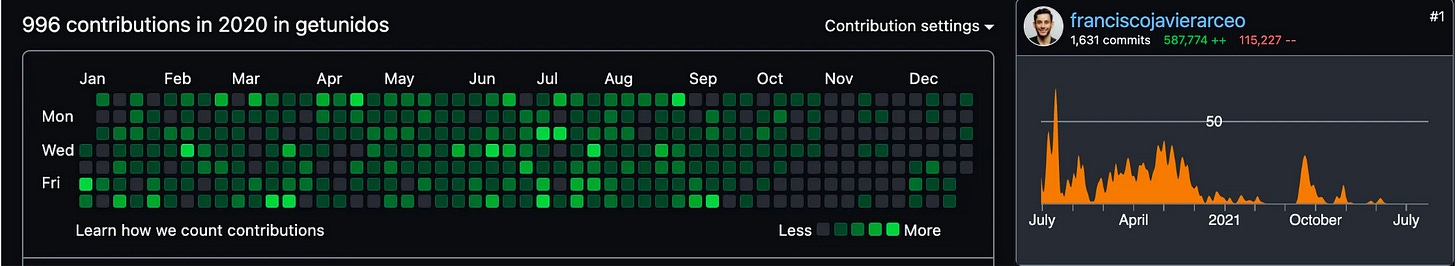

I launched the first version of the product (a web app) in 2020 and you’ll see in the photo below that I wrote a lot of code in that time…all of which only aimed to solve for what I thought my parents and I needed when we were learning about the US financial system, which was an abhorrent waste of time and obviously a very narrow target market.

I used to rationalize not connecting with customers before having a product by telling myself I was being product-centric but that was a lie. At the time I felt I had conviction and I was focusing on solving a real problem with a real solution (look at all that code! that must be something, right?!), but this was dogmatic and wrong…in reality I should have been both product-centric and customer-obsessed.

Eventually I made some course corrections and launched the mobile app in 2021, but I still made most of the same mistakes.

So my startup failed twice, slowly, painfully, and quietly2…and that taught me a valuable lesson.

It is better to fail fast than to die slow. 😉

-Me

With that context, here’s the list of ways I failed:

1. Kept my startup idea a secret

I, like some other first-time founders, thought that I needed to keep my idea a secret so that no one would steal it. This was absolutely stupid. I should have told it to as many people as possible and gotten feedback, maybe they would have convinced me not to do it. More importantly, ideas are free. Words are cheap. Delivering something valuable is hard. Execution is everything.

2. Didn’t talk to customers first

“Build a product and they will come” may be true for some but it’s probably not true for you and it definitely wasn’t for me. I didn’t talk to my target population at all and this really matters. I was so focused on building a product first that I missed this entirely. I often told myself “If I show my target customers this great product they’ll think ‘Oh I need this!’.” Wrong.

I was in that position and not aware of it. 🫠🫠🫠

3. Didn’t listen to the failures of others

There’s a graveyard of Personal Financial Management apps that died trying to monetize their product. I should have seen this as a signal that building the same thing for a slightly different population was very likely to have the same result, but I foolishly rejected this data.

4. Did the marketing myself

I am terrible at marketing, but I had such a strong opinion about how ads, landing pages, and images were supposed to look and sound that I did it all myself. Ironically, when social ads did work it was almost the opposite of what I was expecting which was a strong signal that I really was clueless. Working outside of my skill set was a great experience as I learned how hard marketing is but that wasn’t the goal; the goal was to get customers and I failed miserably at that.

5. Didn’t manage my time well

I spent so much time coding and working on the product that I didn’t plan the work very well. Had I done better planning up front I probably would have wasted a lot less time building. This was a valuable life lesson that I have since corrected but it was a very painful one.

6. Spent way too much time on small details

You care more than your customers do, probably. I spent so much time combing over every small detail out of fear that things needed to be perfect and it was such a waste of time.

7. Wasted time deliberating stuff that didn’t matter

My cofounder and I were very different. He is a consultant and I am an engineer. In some sense it was the pairing of a builder and a critic, which ultimately led us to disagree and talk about our disagreements too much. We argued about everything and none of it mattered. The disagreements always left me frustrated as it was such an emotional drain and time simply wasted. Make sure you find a cofounder you won’t waste time with.

As a brief aside, time is your scarcest resource and as I get older I find that time wasted on things that don’t matter leaves me with a deep sense of regret more than frustration. Imagine all of the good that could have been accomplished with that wasted time! This regret led me to create the “Execution-Planning Tradeoff” framework that I recommend folks that work at big companies or startups to reflect on deeply—for startups, you need to execute to survive, for big companies you need to execute in order for a startup not to eat your lunch.

In short, you’re probably over-planning. There is a 1-to-1 tradeoff between planning and executing but I’ve seen many companies and people make lots and lots of plans because it feels good…but what feels good and what is actually good is often inversely correlated.

8. Didn’t allocate capital to the right things

Like doing the marketing myself, early on I spent too much time doing all of the wrong things. I should have hired contractors to do most of the things I did myself, especially where the cost was relatively low and the yield was high, like building landing pages, facebook ads, writing articles for content. Eventually I did hire consultants but that brought new problems, e.g., not getting exactly what I wanted, struggling to find quality at a “reasonable price” (though I should emphasize that this is kind of a stupid statement, “reasonable price” is dictated by the market, so the reality is I should have been willing to pay more), and stability in high quality contractors.

9. Built everything myself

Coming from a data and machine learning engineering background, I already knew a lot about software but very little at all about web or mobile development. I decided to build everything myself (much of which was reinventing stuff that already existed but were going to provide a slightly better UX) and, while it was an incredible learning experience that has made me a much stronger engineer, it was not an effective approach as a founder trying to make a successful business. I should have started with ads, landing pages, interviews with potential customers, and then built something.

10. Misaligned cofounder

As I mentioned, my cofounder and I were very different. At the time I thought he complemented my skill set well but in hindsight I realized we were too different to be effective together. Adding him as a cofounder was entirely my fault, he’s someone I look up to and has been a mentor but that didn’t make him the right cofounder. If I were to do a startup again in the future, I’d look for a cofounder that complements me but also aligns with my focus on execution, which is where my previous cofounder and I really had issues.

How to avoid some massive failures

The only real failure you should avoid is your company dying, everything else is a learning experience. So, if you are a founder, get used to taking a beating (figuratively)—all that matters is that you get back up and survive.

Make sure to track outcomes and progress against them. Some argue process is everything but outcomes dominate process, especially for startups. If your outcomes aren’t happening, change your approach or business because if you don’t you won’t survive. And remember! Survival is all that matters and being attached to an ineffective process is honestly kind of stupid (and that’s not you!).

Where that led me

My experience at Unidos was lonely and miserable. I left Goldman feeling like I was at the height of my career but my startup was such a colossal failure that I felt emotionally broken, but all of that failure was an extraordinary learning experience. I learned more in the 2 years of my startup than I did in the 8 years of work before it. If I could go back in time, I would do it again.

Being a founder was a very humbling and painful experience, which made me a more empathetic and thoughtful person, and also a much better engineer. I now understand how truly hard it is to build something from scratch, which is why I’m much less likely to criticize founders who are trying to build things (though I’d say often the harsh feedback is the most constructive). If I’m to be honest, I probably would have preferred to stay at Goldman a little longer as I think I had more to learn there, but I’ve made my peace with it.

More importantly, after my startup, I joined Fast and then Affirm, which have been the highlights of my career, so I am truly happy and grateful for all of my past failures, as they led me to where I am today.

Happy failing. 🚀📈📉🧨🪦

-Francisco

Some Recommended Readings

I thoroughly enjoyed Alex Johnson’s “How Fintech VCs can Actually Be Helpful” where he highlighted the disparity in venture for founders from underrepresented backgrounds and gave actionable steps for both founders and investors.

I also recommend reading Nicole Casperson’s “Media’s Role in Fintech Diversity”, where she discussed her presentation at Money 20/20 on the very same topic.

I loved listening to the latest Fintech Recap podcast by Jason Mikula and Alex Johnson where some of my favorite Fintech policy folks discussed Money 20/20 and some predictions for 2023!

Postscript

Did you like this post? Do you have any feedback? Do you have some topics you’d like me to write about? Do you have any ideas how I could make this better? I’d love your feedback!

Feel free to respond to this email or reach out to me on Twitter!

I should note that I was occasionally approached by investors and I politely declined. It was mostly because I thought my business model was terrible and that’s probably a good sign I should have changed it but oh well.

It was in interesting juxtaposition to have my startup fail so quietly and Fast fail so publicly and my opinion is that a public—maybe even slightly embarrassing—failure that makes a splash is far more exciting to be a part of. Most startups die slow unexciting deaths and aren’t even relevant enough to be forgotten, Fast’s implosion, for better or worse, was everywhere.

I think that it's important to analyze where things could have been optimal and weren't, but I think it's even more important to understand the positive aspects of your venture! You have an experience through Unidos that very few other people will have; it's similar to fighting/boxing, where no one can understand unless they've done it.

You jumped out of the plane, you made the commitment, and you know what it takes to venture out into the unknown and try.

The same fearlessness allows you to fail upward, succeeding regardless of circumstance, "successful" venture or not!